With One-Core you can forget the technology and concentrate on your brand and go to market, we will take care of the rest.

Go digital with our frictionless banking solution! Manage customers, acquire new ones, and differentiate your offering from others by becoming a digital-only bank. Integrate with your existing core banking platform and create your own business and consumer ecosystem without a physical branch.

The opportunity to launch a digital bank is now. With large bases of loyal customers, the trust is there. We have provided large retailers and conglomerates with the applications and tools they need to launch their digital bank.

Open banking makes it possible for community groups, underserved organizations, and entrepreneurs to obtain a banking license and provide targeted banking and services to their communities. Our solutions allow for branding, customization, and launching of a cost-effective digital bank.

We offer banks the technology to create targeted digital banks. Our white-label solution is cost-effective and allows for branding and deployment of separate digital banks using our One-Core technology.

Insights that drive digital transformation

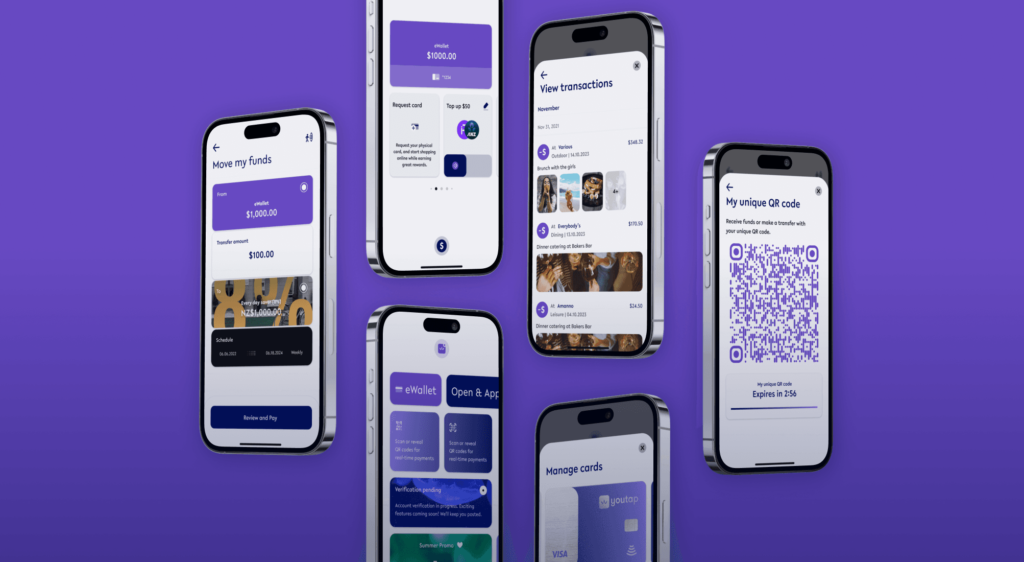

White-label consumer and merchant digital wallet applications that enable you to focus on your go to market.