We have the banking, payments and financial services platform to power the new breed of financial service providers

Youtap, established in 2007, is a dynamic organization dedicated to transforming the financial and retail services industries through innovative technology. Our cloud-based platform partners with renowned tech giants such as Amazon AWS, Microsoft Azure, and Google Cloud, enabling us to deliver a comprehensive suite of digital solutions that serve banks, telecommunications companies, and retailers globally.

As a key player in banking, financial services, fintech, mobile, payments, and transaction processing, our mission is to empower traditional businesses to modernize their operations and offerings. We achieve this by introducing state-of-the-art digital banking, digital wallet, and loyalty software and applications. Our platform offers a broad range of services, from retail and loyalty services to a range of banking and financial services, ensuring that our products cater to the diverse needs of our clients.

Our customer base comprises Tier 1 and 2 retailers, banks, and mobile operators worldwide. Our services include streamlined customer onboarding, payment processing, lending and deposit products, remittances, bill payments, loyalty, and rewards programs, as well as detailed account itemization and reporting.

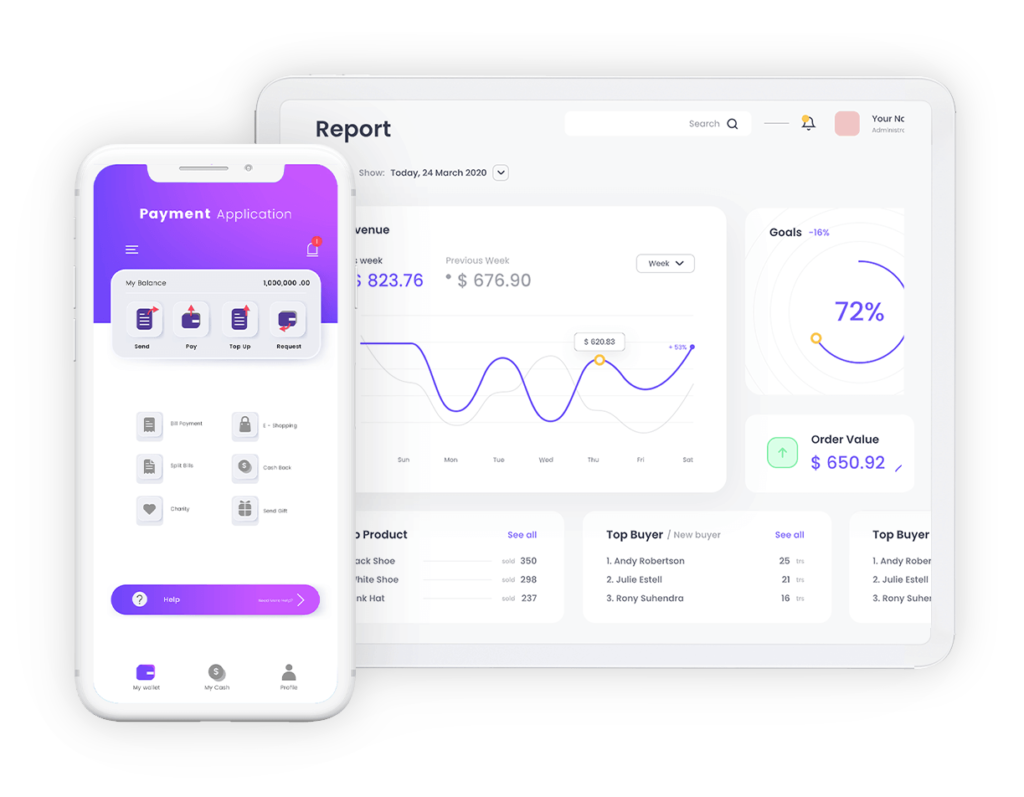

Introducing our B2B2C SuperApp – a revolutionary white-label solution designed for banks and enterprises, tailored to empower their business customers. This SuperApp serves as a powerful tool, enabling businesses to offer a comprehensive suite of financial and merchant services directly to their end-users. From seamless transactions and payment solutions to customized financial management tools, our SuperApp is a one-stop digital platform that enhances customer engagement, fosters brand loyalty, and drives growth. It’s more than an app; it’s a bridge connecting your business customers to their clients, crafted to amplify your brand’s impact and innovate your service delivery in the digital age.

Youtap empowers global businesses with innovative digital banking, wallet, and loyalty solutions to transform customer engagement and drive sustainable finance. We aim to create a future where financial inclusivity is the norm and businesses thrive in the digital age by seamlessly integrating our technology with existing infrastructures. Our goal is to contribute to an inclusive, sustainable world for all stakeholders.

Youtap promotes sustainable finance practices by prioritizing environmental, social, and governance (ESG) considerations in all operations. They offer sustainable investment products and implement eco-friendly processes to make a meaningful difference. By integrating sustainability into financial solutions, Youtap empowers individuals and businesses to make conscious and responsible financial choices for a more sustainable world.

Youtap offers white-label financial services apps for digital transactions worldwide, empowering banks, eMoney issuers, retailers, and financial service providers with real-time processing capabilities.

Youtap offers a complete financial services platform for successful and competitive banking.

Youtap offers white-labeled Digital Banking and Payments solutions to its customers, reducing development and integration costs and speeding up their market entry.