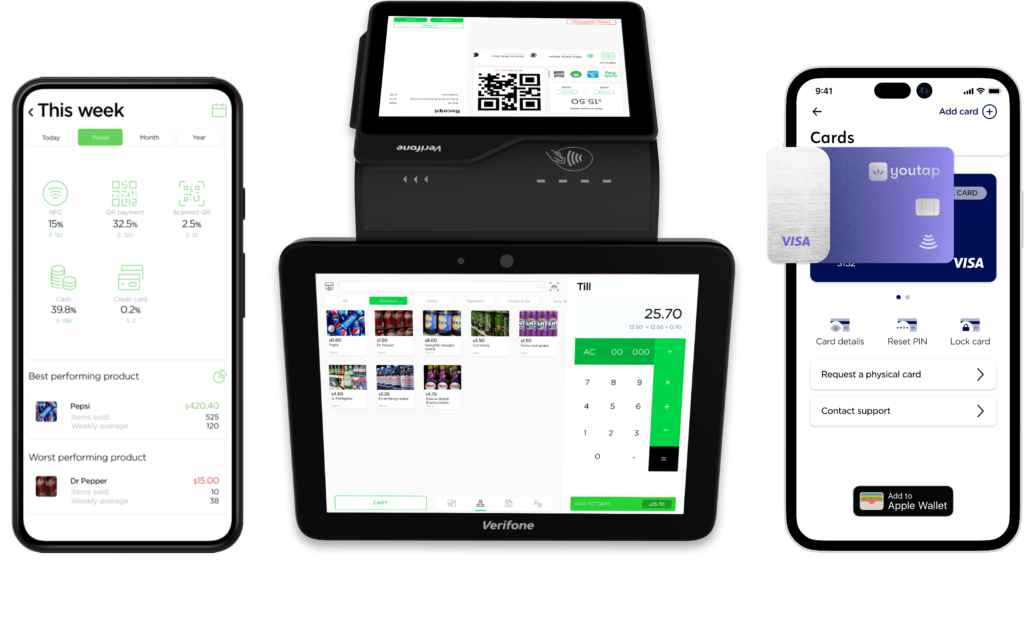

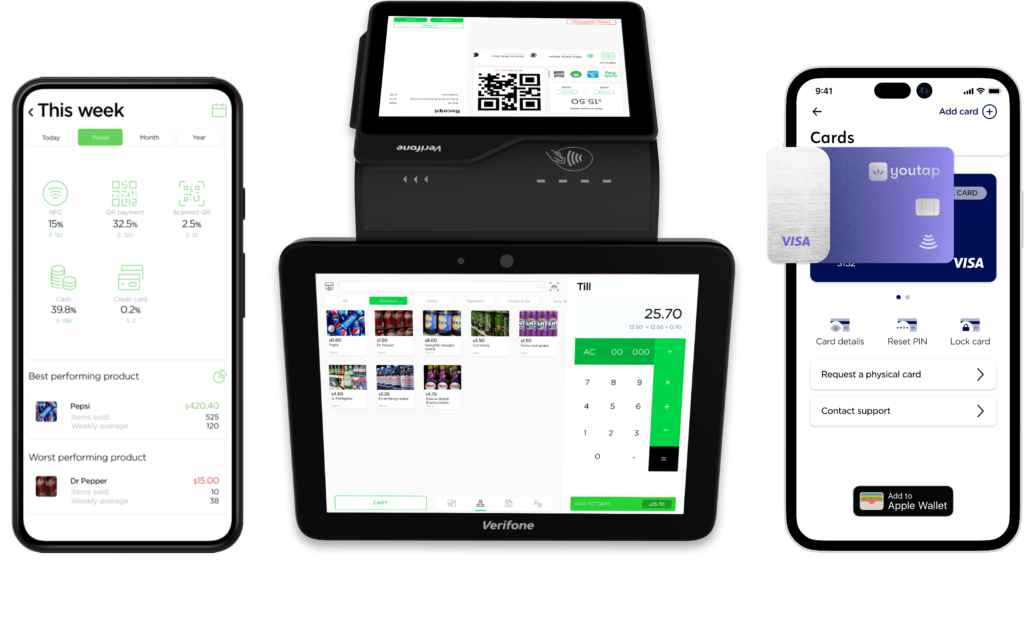

Discover our White-label Merchant Services SuperApp – your key to effortless transactions and enhanced customer experiences. Our comprehensive platform simplifies payment processing and boosts efficiency for businesses of all sizes. With Youtap, expect smooth, secure, and success-driven digital commerce solutions

Youtap provides a comprehensive payments solution for Acquirers, Issuers, Payment Aggregators and Processors. The technology-based platform provides a wide range of payment processing services to different types of organizations in the payment ecosystem.

Brand, Market and Launch with our white-label applications that will transform the Consumer, Business and Retailer experience, find a solution to suit:

Insights that drive digital transformation