Elevate your brand with Youtap’s white-label digital wallet and companion card solution. With Youtap, revolutionize how your customers bank, pay, and shop.

Open loop digital wallets with Youtap offer you unparalleled flexibility by enabling transactions with any bank, financial institution or retail organization, not restricting you to a specific provider, thus making your mobile money experience truly seamless and borderless

Closed loop digital wallets by Youtap provide an exclusive, streamlined transaction experience, designed for use specifically within a particular retailer or service provider’s network, offering you tailored benefits, rewards, and efficient payment processes unique to that ecosystem

Stored value digital wallets from Youtap allow you to pre-load funds into your wallet, providing a secure, convenient, and swift payment method that keeps your finances at your fingertips, ready for immediate use whenever you need it

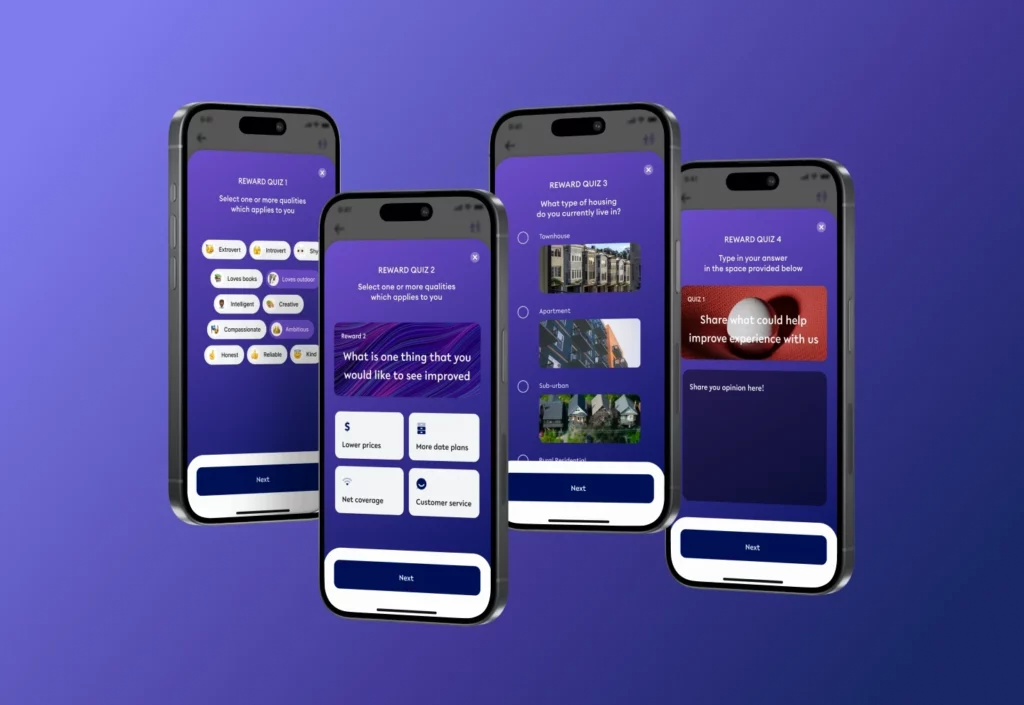

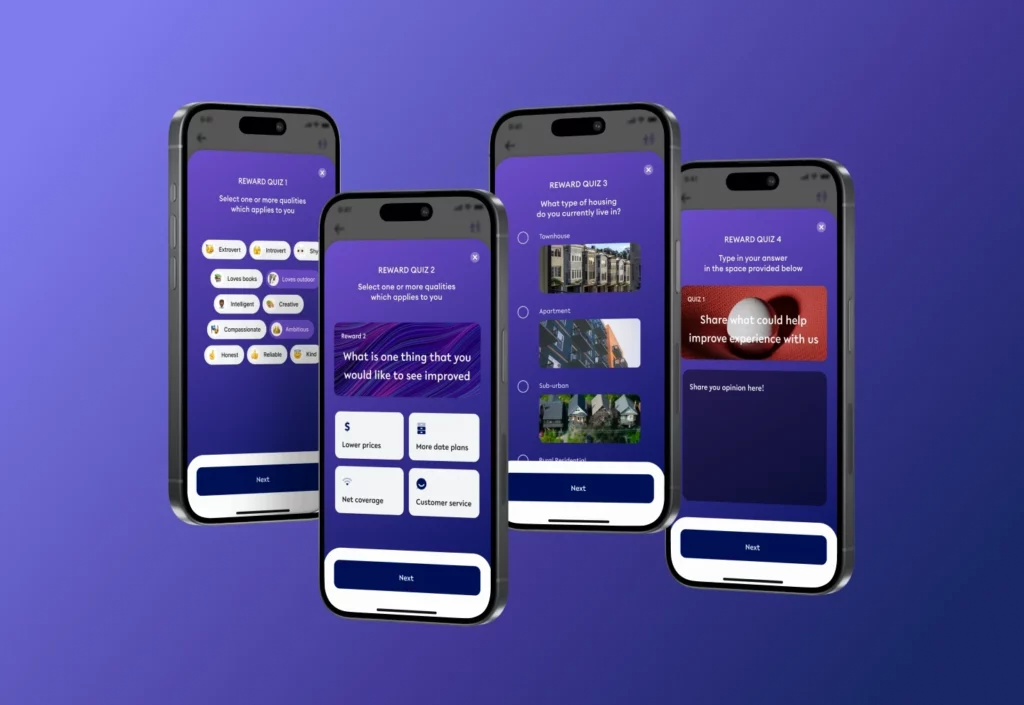

Loyalty digital wallets at Youtap transform your shopping experience by aggregating all your reward points, coupons, and discounts from participating businesses into one accessible platform, ensuring you never miss out on opportunities to save and gain more from your purchases

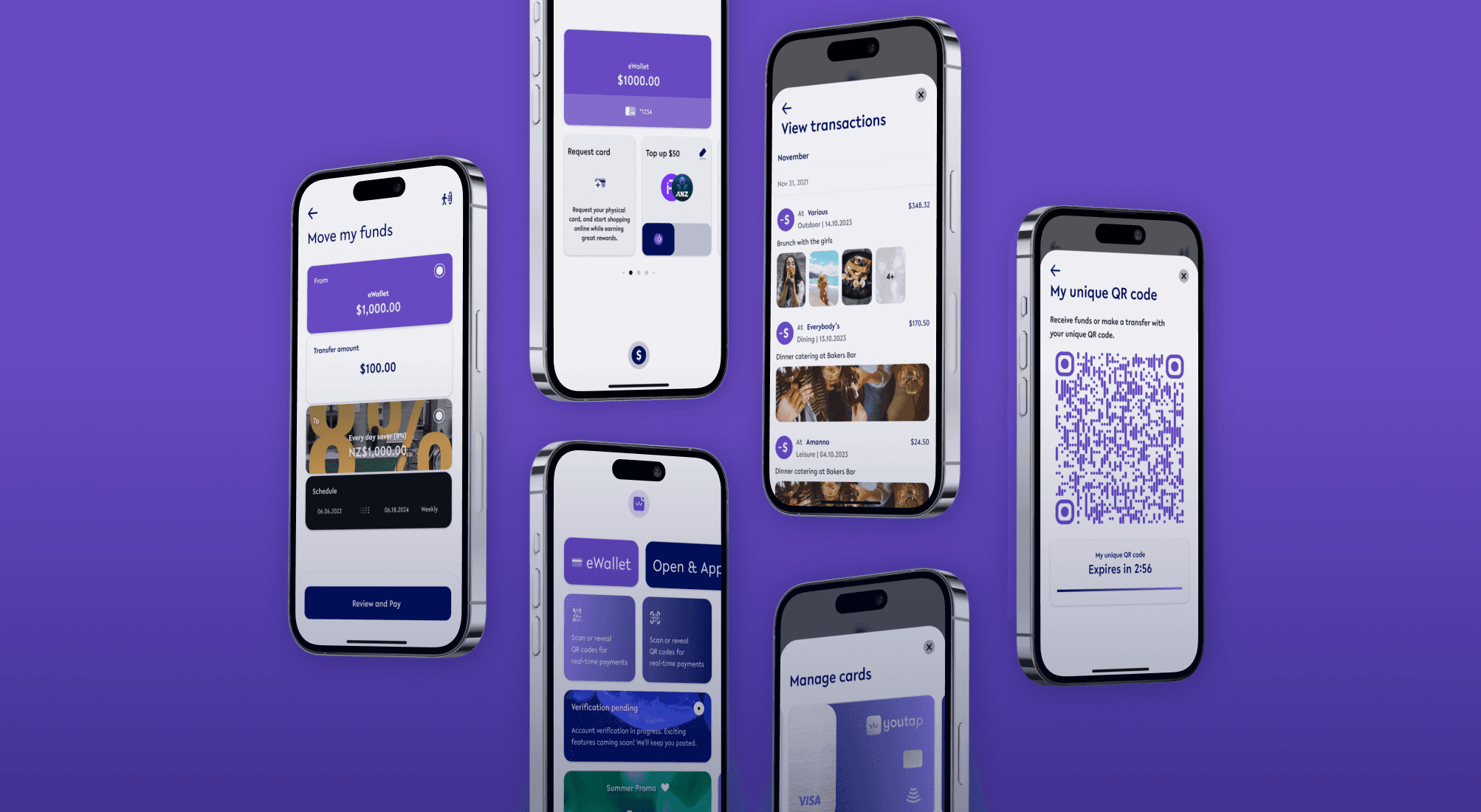

Companion card payments with Youtap integrate the convenience of a physical card with your digital wallet, offering an alternative payment method that broadens your transactional freedom, while maintaining the security and seamless experience of your digital transactions

Youtap’s static and dynamic QR code payments revolutionize your purchasing experience; static codes allow quick payments at familiar places, while dynamic codes provide an extra layer of security for each transaction by generating a unique QR code for every new payment

Person to person payments at Youtap facilitate direct, instant money transfers between individuals, making it simple, safe and efficient for you to share funds, settle debts or split bills, right from your digital wallet to theirs

Bill payments through Youtap empower you to manage and pay your various utility, service, and subscription bills in a centralized, convenient digital platform, making the task of keeping up with due dates and payments both simple and hassle-free

Youtap’s multiple wallet balance feature allows you to efficiently manage and track different currencies or fund categories within your digital wallet, providing a clear, organized overview of your finances and enabling precise control over your transactions

Cash management with Youtap, including ‘Cash-In’ and ‘Cash-Out’ features, provides a seamless transition between digital and physical currencies, enabling you to deposit funds into your wallet or withdraw them as needed, facilitating a holistic, adaptable financial experience

Linking your bank account to Youtap’s digital wallet enables direct fund transfers, creating a continuous, secure flow of transactions that integrates your traditional banking experience with the ease and convenience of digital financial services

Youtap’s split bill feature streamlines your group expenses by automatically dividing costs among friends or family, making it effortless to share meals, gifts, or any other shared expenses, without the stress of manual calculations or awkward money requests

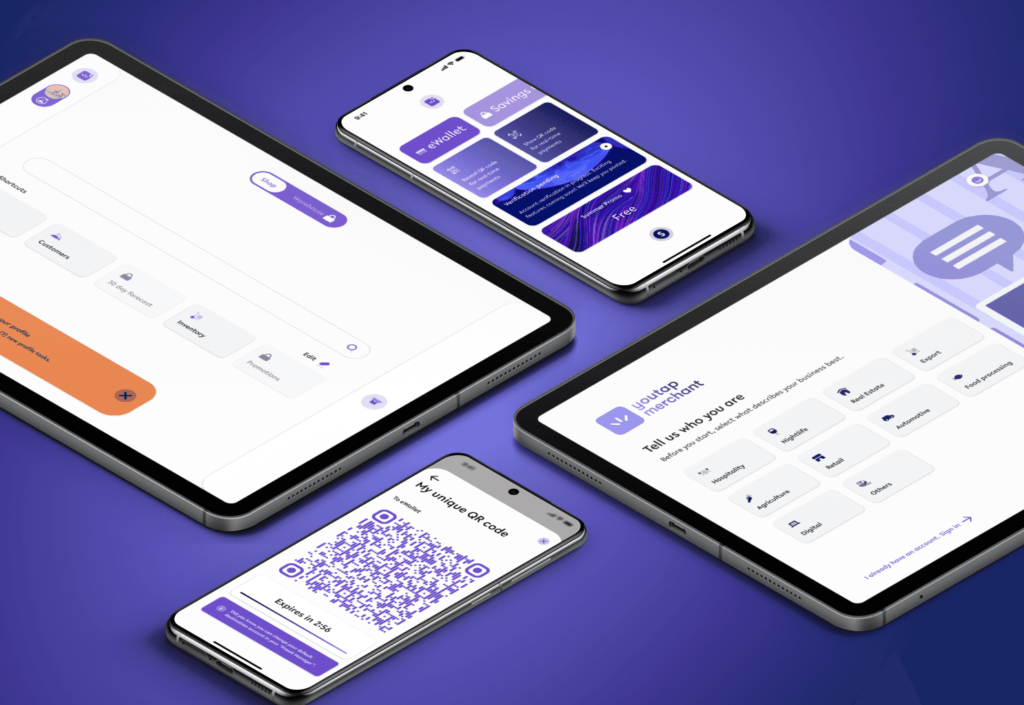

Accelerate your brand growth and foster customer loyalty with Youtap's white-label solutions. Leverage our cloud-based 'ready-to-launch' platform to engage your customers faster than ever - in days, not months. Explore Youtap's diverse portfolio of white-label digital wallet applications and solutions tailored to your needs:

By integrating financial services, digital wallets become a one-stop solution for users, enhancing their utility and value. Additionally, this provides opportunities for banks to expand their reach.

Seamless integration and an intuitive interface contribute to an enhanced customer experience, making the management of rewards and payments easy and convenient.

By providing personalized rewards and a sense of ownership, businesses can foster improved customer loyalty, ultimately reducing customer churn.

A branded in-app wallet and rewards program can boost brand awareness and strengthen brand identity, contributing to the overall brand image.

Tracking and analyzing user behavior can provide valuable data insights, enabling more effective marketing strategies and increased customer satisfaction.

One digital financial services platform, multiple white-label solutions deployed in the cloud, with applications for consumer banking, business banking, digital wallet, payments and retail point of sale.

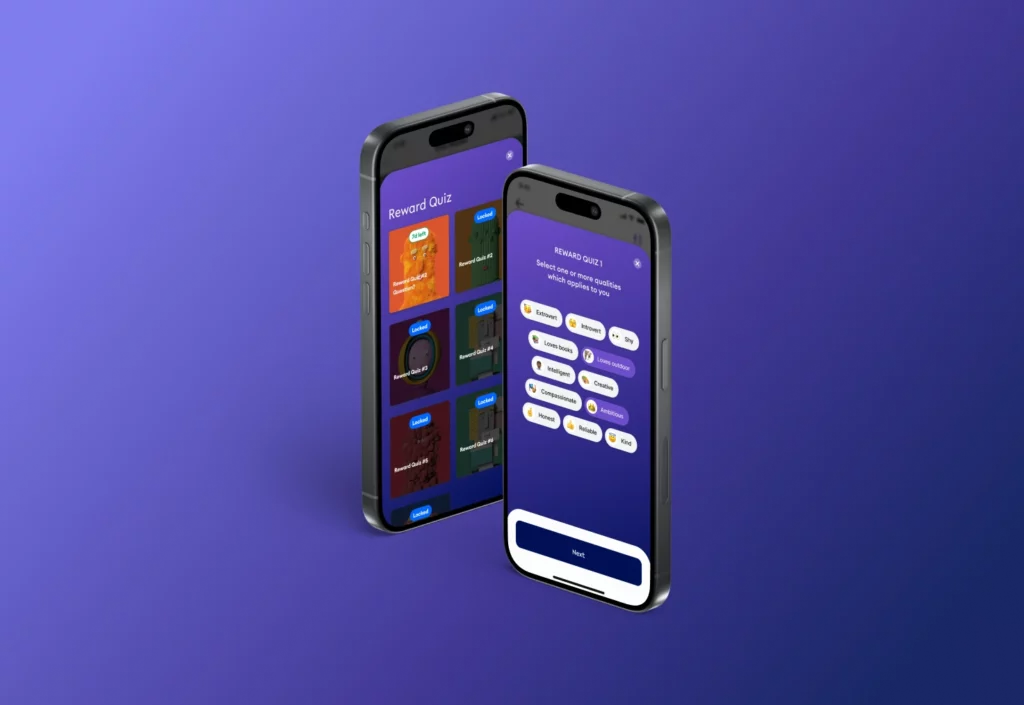

Loyalty digital wallets at Youtap transform your shopping experience by aggregating all your reward points, coupons, and discounts from participating businesses into one accessible platform, ensuring you never miss out on opportunities to save and gain more from your purchases

Loyalty digital wallets at Youtap transform your shopping experience by aggregating all your reward points, coupons, and discounts from participating businesses into one accessible platform, ensuring you never miss out on opportunities to save and gain more from your purchases