Our comprehensive Banking as a Service solution provides a seamless, flexible, and secure platform for your banking needs. With Youtap, you can revolutionize the way you provide financial services, deliver unparalleled customer experiences, and drive your business forward. Experience the power of transformation with Youtap

Transform banking with Youtap’s BaaS. Access core banking functions, white-label solutions, and multiple financial services through our scalable platform. Boost efficiency, revenue, customer engagement, and save costs while ensuring security and compliance. Experience real-time data analytics, multi-currency and language support, and innovate your banking with Youtap today.

Youtap’s BaaS platform offers scalability, allowing financial institutions and businesses to easily expand their operations as their customer base grows

Youtap’s Cloud-Delivered BaaS platform (with full support for AWS, MS Azure and Google Clouds) enables quick deployment and integration, significantly reducing the time required to launch new banking services or expand existing ones

Youtap’s BaaS platform ensures compliance with regulatory requirements and provides advanced security features to safeguard sensitive customer data and financial transactions

Youtap’s BaaS platform offers well-documented APIs, allowing seamless integration with third-party service providers, enabling organizations to leverage a wider ecosystem of financial services and functionalities

Youtap’s BaaS platform provides API access to core banking functions, allowing organizations to offer a wide range of banking services, including account management, transaction processing, loan origination, and more

Youtap’s BaaS platform offers white-label solutions, enabling organizations to customize and brand the banking services as their own, reinforcing their unique identity and enhancing brand recognition

Youtap’s BaaS platform allows seamless integration with other financial services, such as payment gateways, remittance providers, and third-party applications, expanding the range of services offered to customers

Youtap’s BaaS platform is cloud based and designed to scale alongside the organization’s growth, accommodating increasing transaction volumes and user demands. It offers dynamic scalability and flexibility in adapting to changing market dynamics and customer need

Our open banking platform integrates with third-party APIs and SDKs while adhering to industry-standard security and AML protocols. It’s cloud-based, providing enhanced accessibility and convenience.

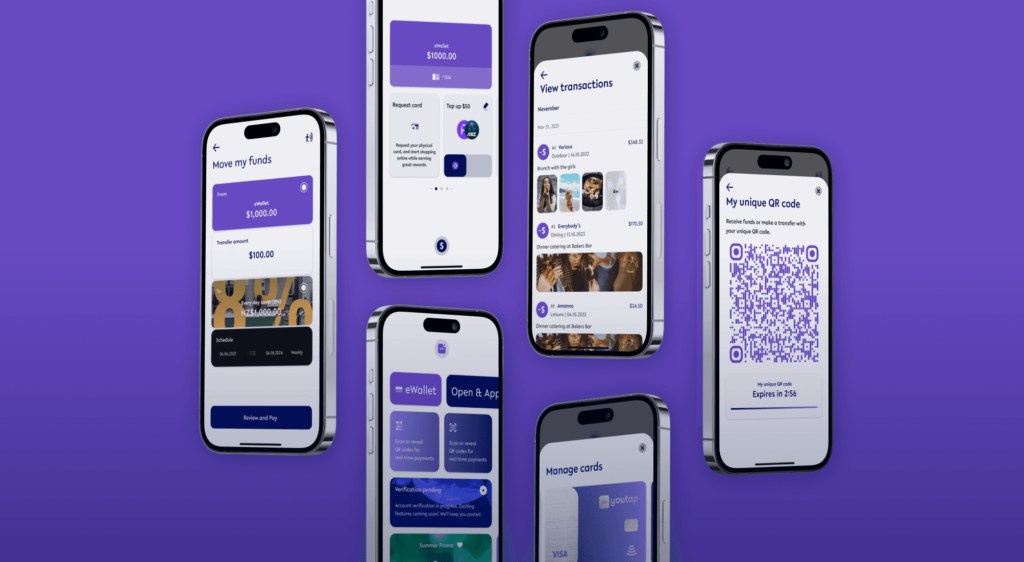

Our app facilitates e-KYC verification on iOS and Android. It offers support for various government IDs, facial recognition, and biometric verification. In addition, it provides configuration options for OTP passwords and data validation parameters. Our application also includes an administrator portal, and it offers customizable features based on KYC levels.

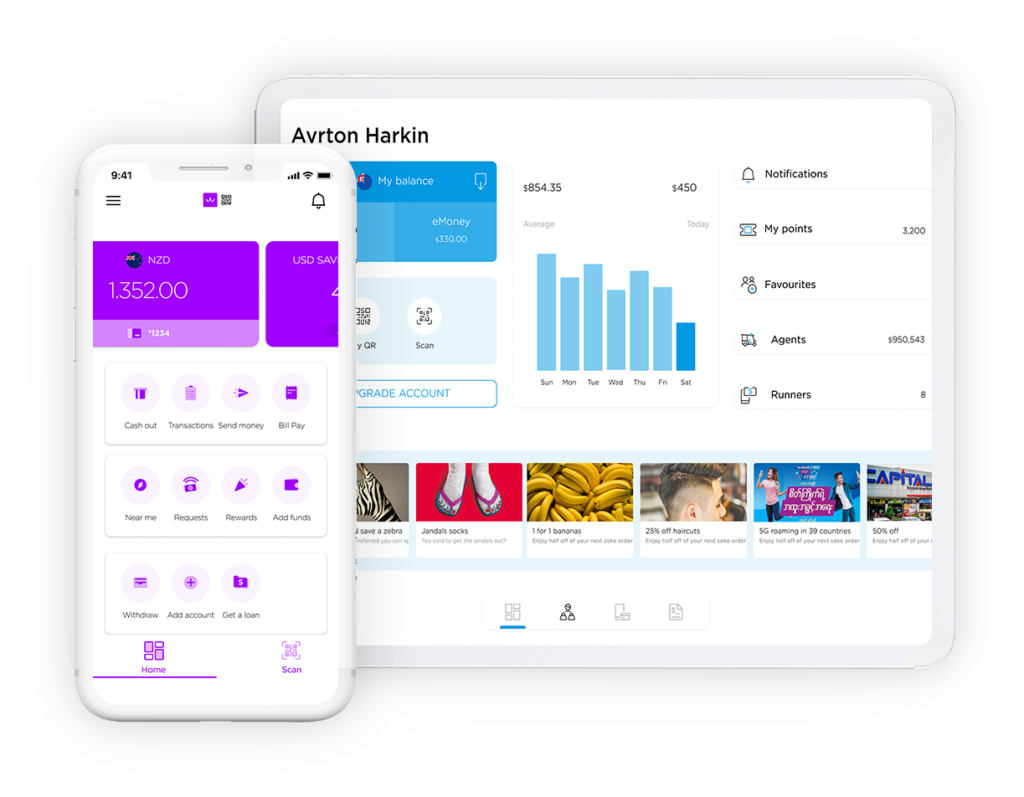

Offering cross-platform iOS and Android-ready white-label applications and support for various features, including digital banking, account management, card application and management, payments, bill payment, remittances, P2P transfers, spend management and profile management.

This platform enables central banks to launch digital currencies and e-money issuers. It has features for payment processing, payment provider management, regulatory licensing, and security. The platform supports all payment types and offers least cost routing, high transaction throughput, and integration with banks, fintech, and payment service providers. There are user-friendly web interfaces, security certifications, and cloud delivery options available.

Our cloud-based system provides high TPS, on-net/off-net routing, terminal management, national payment gateway integration, and card and e-money routing with APIs and ISO 8583 support for bank and payment integration.

This switch supports online and in-store payments, processes QR code, contactless, and EMV transactions, and offers configurable routing capabilities. It is based on industry standards ISO-20022 and ISO-8583 and has a high transaction throughput. It’s cloud-based for added convenience.

We offer a range of services that includes ready-to-use mobile apps, merchant onboarding with e-KYC verification, supply chain and inventory management, payment and cash management, financial accounting, and working capital management, loyalty and campaign management, POS support for various POS systems, as well as agency banking for remote and branchless banking.

Our platform offers onboarding, e-KYC, configurable applications for in-app lending, payments, and processing, for consumer, business, and merchant lending. It also supports IOS and Android. In addition, our platform has configurable APIs for integration with third-party lending platforms, as well as in-app/OTP messaging.

The platform provides card issuance, management, BIN management, virtual and physical card generation, PIN generation, card printing with encryption, integration with online banking and digital wallets, and reporting.

Reports and analytics for administration, customers, and merchants, as well as customizable in-app reports.

The platform includes portals for Admin, Customer Management, Merchant Management, Merchant Customer and Consumer Customer.

We have integrations with top-tier core banking solutions like Temenos T24, Oracle FlexCube, Mambu, etc. Our APIs are comprehensive and support integration with leading third-party platforms. Additionally, we offer SDKs for our microservices platform.

Insights that drive digital transformation

One digital financial services platform, multiple white-label solutions deployed in the cloud, with applications for consumer banking, business banking, digital wallet, payments and retail point of sale.