Youtap stands as a transformative force in the banking sector, aiding institutions in upgrading their digital infrastructure, enhancing customer engagement and loyalty, fostering SME partnerships, and streamlining transaction management. Youtap is enabling banks to offer white-label variants of its merchant services and digital wallet solutions as a B2B solution to their customers, enabling these banks to target new revenue streams, cultivate enterprise customer relationships and develop new account and transactional relationships.

In the rapidly evolving landscape of financial services, banks are continuously seeking innovative solutions to enhance their digital capabilities and meet the growing demands of modern customers. Youtap emerges as a pivotal partner in this transformative journey, offering a comprehensive suite of services and solutions designed to revolutionize the way banks interact with their customers and conduct business.

Upgrading Digital Banking Services: A Partnership Approach

Youtap’s strategic collaboration with banks is at the forefront of modernizing digital banking services. By integrating cutting-edge technology, Youtap aids in refining online and mobile banking platforms, making them more intuitive, secure, and efficient.

E-Wallet Solutions: Enhancing Customer Engagement

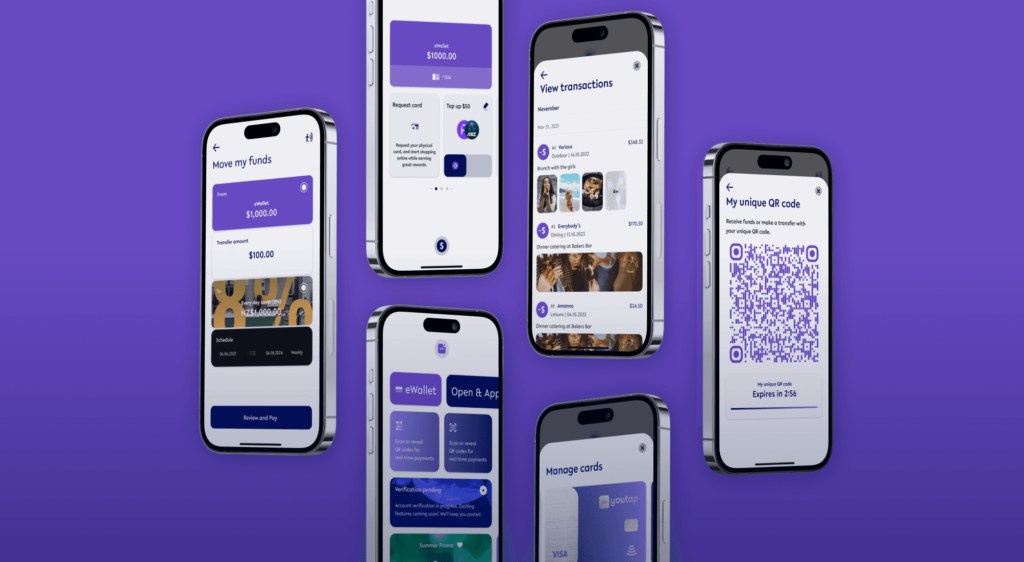

The adoption of E-Wallet solutions by Youtap marks a significant leap in digital customer engagement. These wallets offer a seamless and rapid transaction experience, thus elevating the overall banking experience for users.

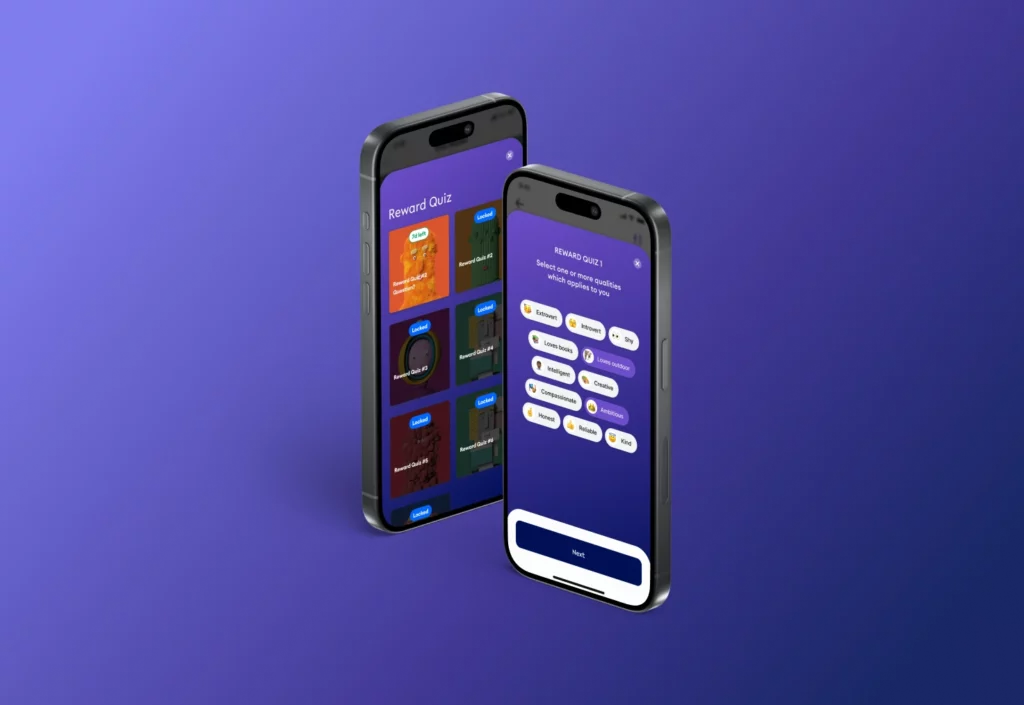

Youtap’s innovative Loyalty Platform is a game-changer for banks aiming to boost transaction volumes and customer loyalty. By offering personalized banking journeys and rewards, this platform is a cornerstone in enhancing customer retention and satisfaction.

Merchant Application: Empowering SME Partnerships

Recognizing the importance of SMEs in the banking ecosystem, Youtap introduces a Merchant Application specifically designed to strengthen bank-SME relationships. This tool facilitates effective transaction management and customer engagement for businesses, fostering growth in the SME sector.

Advanced Transaction Management and Analytics

Youtap’s solutions are equipped with advanced transaction management features and analytics tools. This empowers banks with faster transaction processing, secure data handling, and insightful customer analytics.

Youtap has established partnerships with leading banks to incorporate our e-Wallet solution into the banks service offerings, enabling these banks to provide white-label financial solutions to their enterprise clients. Our banking partners recognize the advantages of becoming a SuperApp, which includes offering in-app payment and transaction support for their retail, transportation, and large enterprise customers.

The seamless integration of the e-Wallet with the banks’ existing systems has facilitated a smooth transition, resulting in increased customer satisfaction and engagement. The e-Wallet presents a secure, easy-to-use, and convenient platform for daily transactional activities. This allows banks to offer a solution to their enterprise customers, especially those with existing consumer applications, by integrating it into their current apps. Consequently, these enterprise customers can access financial services directly from the bank’s platform, enhancing their overall user experience.

Our loyalty and reward offerings played a key role in the strategy of a mid-sized bank to improve its customer relationships. By implementing customized offers and focused promotions, we saw a notable increase in customer engagement. This personalized approach encouraged more frequent and higher-quality interactions, leading to a banking experience that felt more individualized to each customer.

Thanks to the flexibility of our platform, the bank was able to tailor its loyalty programs to meet the unique needs and goals of its customers. This alignment led to enhanced customer loyalty and a rise in transaction volumes, demonstrating the effectiveness of a customer-centric approach in the banking industry.

Our Merchant Services played a pivotal role in transforming how a regional bank provided support to its small and medium-sized enterprise (SME) clients. Our customer was able to provide white-label merchant services and point of sale offerings to their enterprise retail customers. By offering critical tools like real-time sales tracking and in-depth customer data analysis, these services enabled SMEs to refine their operations and enhance customer interactions.

The user-friendly design of the application ensured smooth and effortless onboarding for SMEs. This ease of adoption led to significant improvements in operational efficiency and the strengthening of customer relationships. Additionally, SMEs experienced a noticeable increase in sales, highlighting the effectiveness of our Merchant Services in fostering business growth.

We help banks of all sizes go digital with complete digital banking and virtual wallet solutions.

Launch your digital bank easily using our all-in-one solution, including software, modules, and branding tools.

Youtap AgriTech enables managing, onboarding and KYC for farmers for governments, banks and financial service providers.

Digital data enables rapid adaptation and fast decision-making by lenders, investors, insurers, and customers.

Insights that drive digital transformation

White-label consumer and merchant digital wallet applications that enable you to focus on your go to market.