Youtap offers a comprehensive digital finance solution for financial institutions and businesses, including account management, payments, digital wallets, loan origination, and fraud detection. Its adaptable design meets specific business requirements and customer needs for seamless, superior financial services. Choose Youtap for innovative solutions and effortless digital finance navigation.

Youtap offers real-time financial processing through their cloud-based switching technology. This ensures quick and reliable services with low latency and high availability. Youtap’s infrastructure provides cost-efficiency, enhanced security, and scalability to meet growing demands. With Youtap’s real-time capabilities, companies can boost customer experience, decrease fraud risk, and increase revenue growth. Discover the benefits of Youtap today.

Real-time transaction processing, and transaction routing. Real-time fraud, and AML monitoring and reporting.

Youtap utilizes a microservices architecture with a core session control as the real-time hub for all services. Our cloud-based architecture uses scalable containers to ensure that scalability, reliability, and performance are always maintained.

Youtap has adopted a cloud-based architecture used by thousands of organizations globally. Some of the world’s largest banks and financial service providers have adopted its cloud-based architecture, offering a high degree of scalability, security, and flexibility. Youtap’s solutions are deployed in PCI compliant data centers with ISO27001 certification providing the tools to automate and monitor all aspects of a customer’s cloud instance for compliance and reporting.

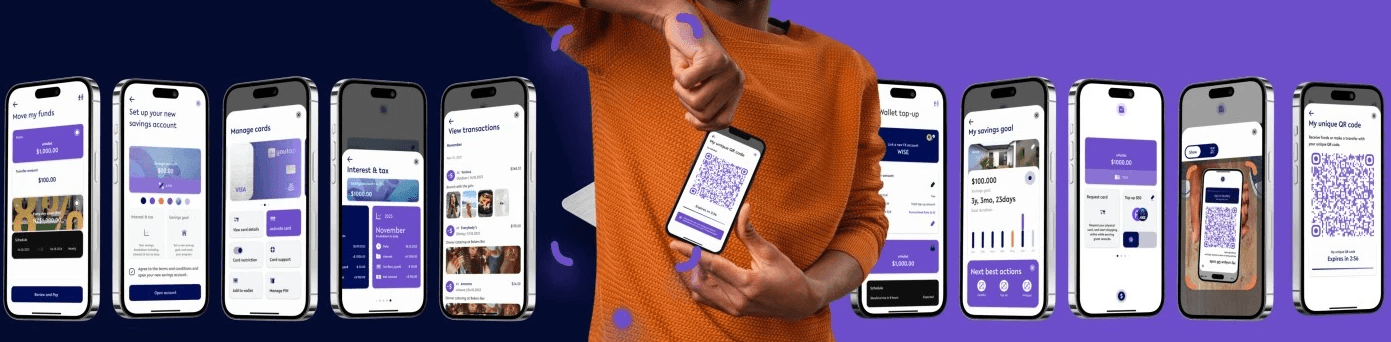

Embrace our white-label digital banking, digital wallet and payments applications to expand your digital capabilities and offer your customers a seamless digital experience. With our white-label platform, you can quickly launch your digital banking, digital wallet, and payment services and differentiate yourself from the competition while providing a superior customer experience.

Our platform is designed to provide a comprehensive and customizable solutions for financial institutions and businesses to launch their digital banking, digital wallet, and payment services under their brand. The platform includes many features: account management, transaction processing, digital wallet management, loyalty program management, and rewards redemption. It supports various payment methods, such as credit/debit cards, ACH, e-wallets, and more.

Youtap simplifies transactions and boosts customer engagement with advanced payment processing, loyalty programs, and POS products. Our solutions integrate seamlessly with existing systems and streamlines transactions, leading to revenue growth and customer satisfaction. Join the future of retail with Youtap.

This platform can process high volumes of banking, payments, and retail transactions in real-time. It supports a range of financial services including real-time eMoney and digital currency routing, POS payment processing and switching, cash management, and remittances.

Our digital banking core has all the essential modules for account management, security, card issuing, lending, rewards, and reporting, as well as white-label applications for launching a digital banking service.

We have a loyalty server for managing promotions, discounts, cash-backs, and points for merchants and consumers. It includes an administrative interface for campaign setup and management.

Create and launch your own Digital Wallet with integrated Loyalty and Rewards, and a companion Visa Card. It can function as a Digital Banking or Loyalty and Rewards solution, and can be upgraded to offer various financial services like deposits, lending, remittance, and merchant acceptance.

A mobile solution for retail and small businesses to get short and medium-term finance quickly. It lets customers personalize and launch a lending service in just a few weeks.

A mobile solution for banks & financial providers to reward customers. Customers can onboard, open accounts & manage through custom apps/portals.

Enable easy self-onboarding for customers to apply for multiple accounts and manage them via preset templates and tools in their internet/mobile applications.

Our platform offers financial services for farmers from managing inputs to loan settlement, making it easier for Agri Banks and financial service providers to serve this critical market.

Youtap platform processes various payment types like Scheme Card, eMoney, QR code, NFC and EMV card transactions. With our payment processing module, Banks, eMoney Issuers and Payment Processors can quickly and cost-effectively setup, issue and process cards and payments.

Youtap’s card management offers all the necessary tools for issuing and managing different types of cards like credit, debit and stored-value. These tools include card range, BIN and print management as well as integration with our digital wallet for self-provisioning, ordering and management.

Our switch manages issuers and acquirers for banks and financial service providers, providing intelligent transaction routing, management, and processing. It caters to eMoney, scheme card, and new digital currency processing, designed for the digital currency future.

The solution manages POS devices and software updates for in-store agency banking through partnerships with device providers.

The solution offers documented APIs for third-party integration.

Youtap technology is trusted by top retailers, transport operators, mobile operators, and banks who prioritize security. All data is encrypted and protected with multi-tiered access rules, adhering to Maker Checker principles.

The platform uses microservices architecture to allocate system resources based on application and priority. It is cloud-based and easily scalable to support tens of thousands of transactions per second.

Pay-as-you-go cloud model offers modules that are easily activated without design integration. Automatic scheduling of hardware, software, and application updates with monthly release cycles that don’t require downtime.

Youtap Platform is secure and responsive for both cloud and on-premise deployments.

The platform is resilient with redundant deployment, load balancing, and data center failover.

Control everything on Youtap Platform and Wallet with our White-label portals.

Our solution offers in-app and portal analytics and reporting, turning data into full-screen dashboards to visually share and analyze customer behavior, including in-app spending and saving patterns. We also provide easy access to all your data for better decision-making.

One digital financial services platform, multiple white-label solutions deployed in the cloud, with applications for banking, finance and retail.