Enabling Banks and Financial Institutions to Launch and Scale Digital Banking, Embedded Finance, and Orchestrated Financial Services.

Youtap empowers banks, financial institutions, and fintechs to accelerate their digital transformation with secure, white-label digital banking and orchestration solutions. Our platform enables institutions to deliver scalable, compliant, and engaging financial experiences across mobile and web — all through a single orchestration layer that simplifies integration and accelerates time-to-market.

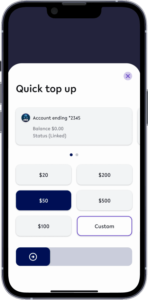

Launch branded digital banking experiences for retail, SME, and agent banking customers. Youtap provides pre-built applications and APIs for digital onboarding, KYC, savings, deposits, payments, lending, and account management — all customizable to your regulatory and market needs.

Simplify integration with existing core systems, third-party services, and fintech providers through Youtap’s orchestration engine. Consolidate workflows, manage APIs, and deliver seamless digital experiences without disrupting legacy infrastructure.

Extend your services to partners and ecosystems via Banking-as-a-Service (BaaS). Use our platform to embed payments, credit, and insurance into retail, agriculture, mobility, and digital commerce platforms.

Deliver personalized, gamified customer experiences with real-time campaigns, tiered rewards, and referral programs to increase customer retention and engagement.

Automate your lending workflows from application to disbursement. Our platform supports digital document management, alternative credit scoring, and rule-based decisioning for both secured and unsecured lending products.

We help banks of all sizes go digital with complete digital banking and virtual wallet solutions.

Launch your digital bank easily using our all-in-one solution, including software, modules, and branding tools.

Youtap AgriTech enables managing, onboarding and KYC for farmers for governments, banks and financial service providers.

Digital data enables rapid adaptation and fast decision-making by lenders, investors, insurers, and customers.

Insights that drive digital transformation

White-label consumer and merchant digital wallet applications that enable you to focus on your go to market.