Banks and financial institutions implement Youtaps digital platform to improve operational efficiency and decision-making processes. Youtap enables faster processing and enhanced customer service. Compared to traditional systems, digital solutions offer reduced costs and simplified maintenance. With the growing use of mobile applications for activities such as lending, insurance, and investment, financial institutions are increasingly developing their own apps to enhance customer engagement. Youtap provides the necessary digital infrastructure and tools to help these institutions deliver seamless and efficient services to their customers.

Our lending Apps help expand your customer base with access to a variety of lending products, including short and long-term options. With real-time credit scoring and lending APIs, customers can easily apply for loans. We streamline the branding and launch process for a hassle-free lending service.

Retain customers with our investment apps that brand and launch digital products quickly, whether pairing investors with lenders or enabling digital investing.

Launch a variety of lending products with our Apps! Our APIs offer real-time credit scoring for short-term and long-term pair-to-pair lending. We provide a frictionless way to help your brand and launch your lending service and grow your customer base.

Consumers and Small businesses crave digital insurance products for convenience. We offer instant quotes and purchasing options for coverage, including vehicle, home, contents, and small business inventory. We also enable branding and launching features.

Insights that drive digital transformation

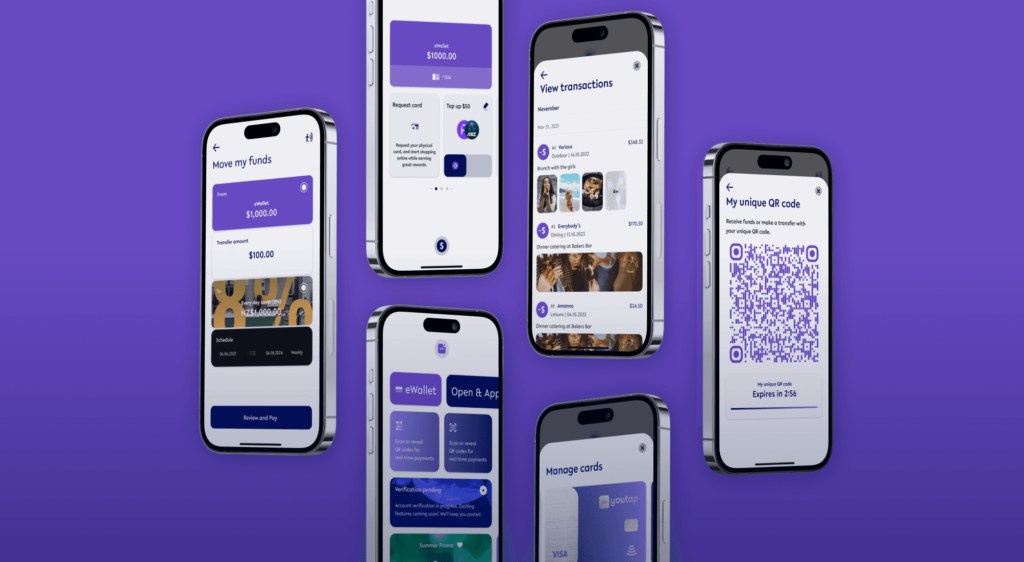

White-label consumer and merchant digital wallet applications that enable you to focus on your go to market.