We Need to Move Now!

Digital Wallets are not only the future of payments but the future of centralising information, loyalty schemes, smart marketing & more. New Zealand and Australia need a tailored Digital Wallet- Will it be you who brings this to market?

The mobile phone is the most convenient transaction medium for banking and financial services applications. The mobile wallet enables loyalty and rewards on a grand scale, it also enables open and closed loop payments, companion Visa and MasterCards, depositing, withdrawing and transferring money to and from a secure, stored-value account within a financial service provider’s network.

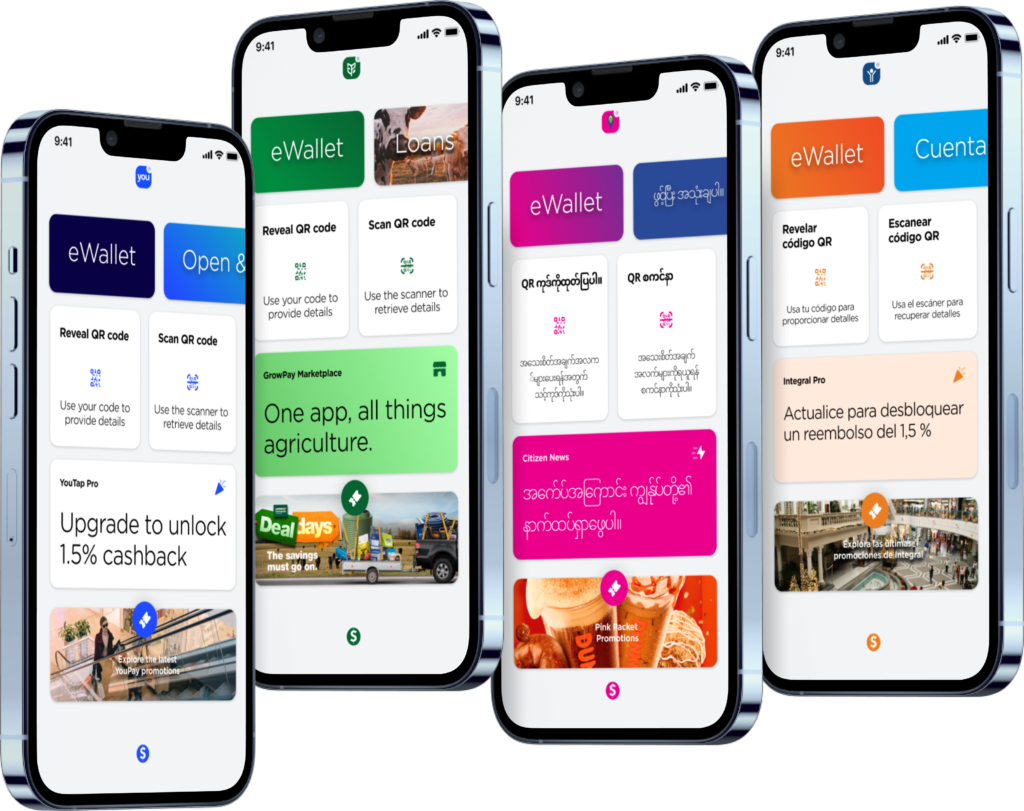

We provide loyalty and financial service providers globally with the infrastructure and expertise to launch a mobile first digital wallet application into their target market. We provide the white-label services, APIs and deployment expertise to make your launch a success.

Loyalty and rewards providers globally, large brands and financial services are redefining their customer interaction and increasing their customer loyalty.

Why you should use a Digital Wallet as part of your offering.

A digital wallet is more secure than your physical cards and wallets because your actual account numbers are stored within the digital wallet, it is converted into a unique code via encryption.

If you lose your physical wallet someone immediately has access to your cards and personal information like a drivers licence while access to a digital wallet is protected by several layers of authentication via your phone & apps.

Brand and launch your digital financial service in weeks not months.

One digital financial services platform, multiple white-label solutions deployed in the cloud, with applications for consumer banking, business banking, digital wallet, payments and retail point of sale.