eMoney issuance at the speed of digital, capitalize on the shift from cash to digital.

Youtap provides a comprehensive e-money issuing and acquiring platform is a software system that enables financial institutions and merchants to issue, process and accept e-money transactions. The platform includes E-Money Issuing, E-Money Processing and E-Money Acquiring features and functionality.

E-money platforms are becoming increasingly popular as they provide a more efficient and convenient way to make payments. They can be used in both online and offline transactions, and are typically integrated with E-money digital wallets and payment cards

Accept both alternative payments and credit/debit through one service:

The solution provides configurable routing based on routing tables, this allows operators to route transactions based on destination, origination, time, date and a range of configurable options.

The platform supports payment processing for eMoney issuers, Digital currency providers and Cryptocurrency exchanges enabling optimised routing of transactions through a variety of traditional and digital currency providers and exchanges.

Well documented APIs are provided to integrate with third party ATM, POS gateway and Payment Processing switches. The solution provides ready to use adapters for ISO 8583 and ISO 20022 and supports web services, HTTPS and customisable APIs.

Youtap’s real-time processing switch provides real-time transaction processing with optimised routing and high transaction throughput. The solution supports a minimum of 2000 transactions per second (TPS) and has been benchmarked to 8000 TPS.

The platform supports a variety of value-added services and digital banking applications and modules.

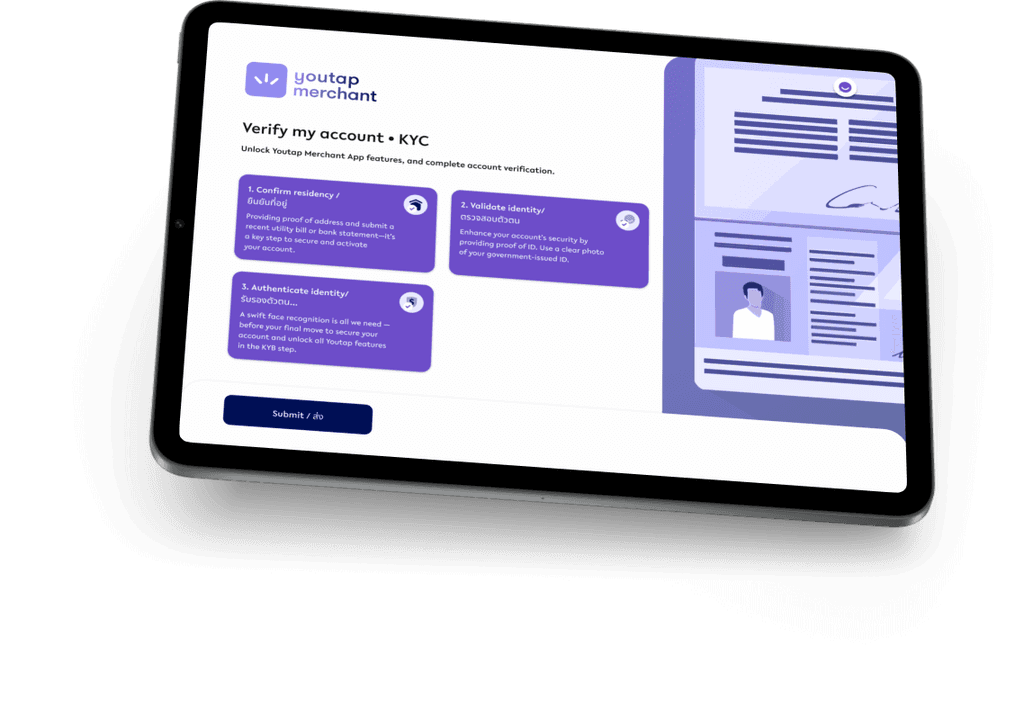

A purpose built and customisable solution for acquiring and onboarding merchants.

The solution can be deployed in a private cloud or public cloud configuration. The solution can be horizontally and vertically scaled and makes use of Kubernetes to quickly scale the processing capability of the platform to support peak transaction loads. Based on customer requirements the solution offers up to 99.999% service uptime.

Through the administration portal the operator can configure all fees and charges, these can be configured to support specific issuers and acquirers, card holder fees, ATM surcharges, bill payment fees and origination and destination fees. Flat rate and percentage based fees are also supported along with start date and end dates.

A purpose built and customisable solution for acquiring and onboarding merchants.Youtap provides skinnable web portals enabling users to view their accounts, transfer funds between accounts or other users, pay bills, and apply for financial services such as loans and savings accounts.

Youtap’s customer management system and administrator management systems enable you to customize and manage your offering and services, including reporting on all aspects of the service.

One digital financial services platform, multiple white-label solutions deployed in the cloud, with applications for consumer banking, business banking, digital wallet, payments and retail point of sale.