Deliver a next-generation banking experience with Youtap Digital Banking. Our cloud-native, API-driven platform empowers banks, fintechs, and financial service providers to offer secure, real-time digital banking solutions across mobile, web, and POS. With digital onboarding, multi-currency accounts, instant payments, and financial insights

Our platform fosters cost-efficient digital customer engagement, reducing the need for physical branches and promoting self-service banking.

Enjoy a highly customizable platform that caters to the unique needs of banks and their customers. This allows for personalized products, services, and offers tailored to individual usage patterns and preferences.

Benefit from comprehensive security measures, including encryption, KYC procedures, AML processes, and secure login protocols, ensuring the protection of customer information and mitigating potential risks of fraud.

Youtap’s solution can connect to a Core Bank ledger via secure APIs or function as a standalone solution, offering a range of consumer, merchant, and back-office applications as required for digital transformation.

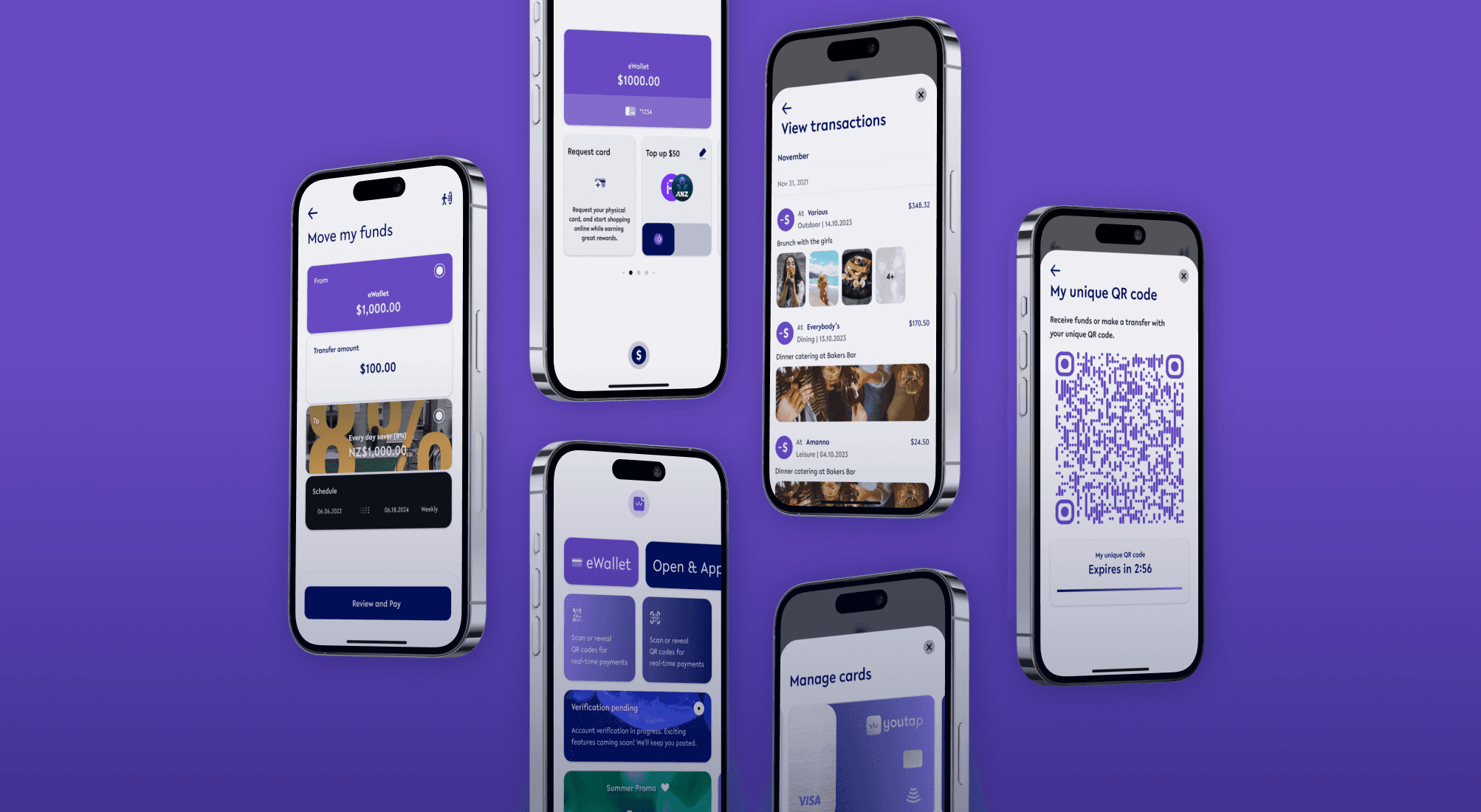

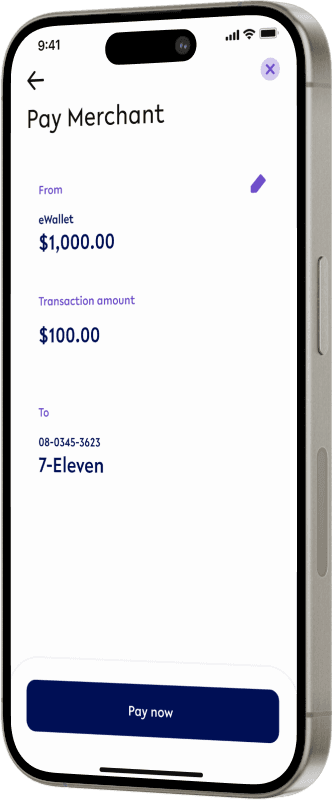

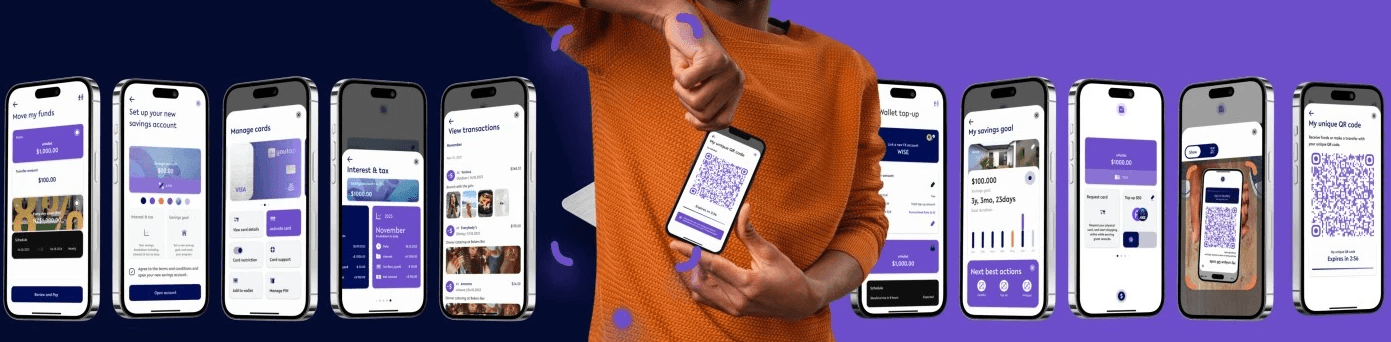

Youtap offers apps that can be customized (or “skinned”) to fit the branding of the bank or financial institution using it. Through these apps, customers can review transactions, transfer funds between accounts, make payments, send money to family and friends, apply for loans, insurance, and other financial services.

Youtap’s platform allows consumers and businesses to open accounts and onboard themselves using electronic Know Your Customer (eKYC) processes. This system validates customer information with multiple cloud-based Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) database providers.

Youtap’s digital banking solution has integrated AI that learns customer behaviors, understands their goals, and can make recommendations to introduce new services and increase their financial wellbeing.

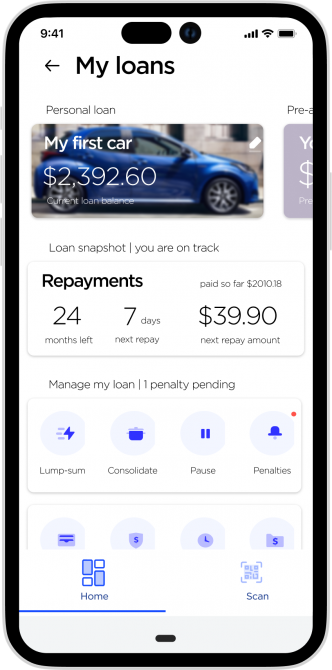

The platform has integrated lending and credit assessment tools and APIs for connectivity to third-party credit assessors and underwriters. It includes tools to create and manage lending portfolios, offering services like micro-lending, mortgage lending, and buy now, pay later offerings.

The platform supports wallet-to-wallet (person-to-person) transfers and both domestic and international remittances for both the sending and receiving of funds.

Youtap’s platform includes integrated card processing, issuing, and management capabilities, enabling banks to issue MasterCard and Visa companion cards and manage these cards.

Youtap’s Agency Banking provides lightweight digital banking services in the field with an agent app that enables users to securely register for services in real-time, deposit and withdrawal funds, and pay bills and airtime top-ups.

Youtap’s digital banking solution is deployed as a cloud solution, which can be set up as a single cloud instance or as a multi-tenant instance. Youtap works with Google, AWS, and Azure, among other cloud providers.

Youtap enables banks to launch a full suite of retail point of sale applications for their retailer customers. These applications include full point of sale, payments, and reporting for retail.

Youtap’s platform has comprehensive security measures, including encryption, KYC procedures, AML processes, and secure login protocols, to ensure the protection of customer information and mitigate potential risks of fraud.

Understanding Your Needs: We begin by thoroughly understanding your business goals, target audience, and specific requirements.

Custom Design and Development: Our expert engineers design and develop bespoke solutions, including core banking systems, mobile banking apps, and web portals, tailored to your brand and customer needs.

Agile Methodology: We utilize agile methodologies, with iterative development and sprints, to ensure rapid delivery, continuous feedback, and flexibility to adapt to changing requirements.

API-Driven Integration: We leverage APIs to seamlessly integrate our solutions with your existing infrastructure and third-party services, ensuring a cohesive ecosystem.

White-Label Solutions: Our white-label platform allows you to launch digital banking services under your own brand, providing complete control over the customer experience.

Rigorous Testing and Quality Assurance: We conduct thorough testing throughout the development process to ensure the security, stability, and performance of our solutions.

Deployment and Support: We deploy the solutions on your preferred infrastructure (cloud or on-premise) and provide ongoing support and maintenance to ensure smooth operation.

Solve your bank’s digitalization challenges and get to market quickly. Offer MSMEs and new customers better user experiences through our modular architecture, simple API integrations to your core banking solution with easily customizable interfaces and applications.

Youtap supports the definition of multiple account types per user, e.g., everyday accounts, savings, and loan accounts. Additional support for multiple users per account, such as family and joint accounts.

Youtap provides skinnable web portals enabling users to view their accounts, transfer funds between accounts or other users, pay bills, and apply for financial services such as loans and savings accounts.

Youtap’s customer management system and administrator management systems enable you to customize and manage your offering and services, including reporting on all aspects of the service.

Insights that drive digital transformation

White-label consumer and merchant digital wallet applications that enable you to focus on your go to market.